43+ can i get a mortgage with a state tax lien

Dont Settle Save By Choosing The Lowest Rate. Web Some home loan types are easier to qualify for even if you have a tax lien such as an FHA loan.

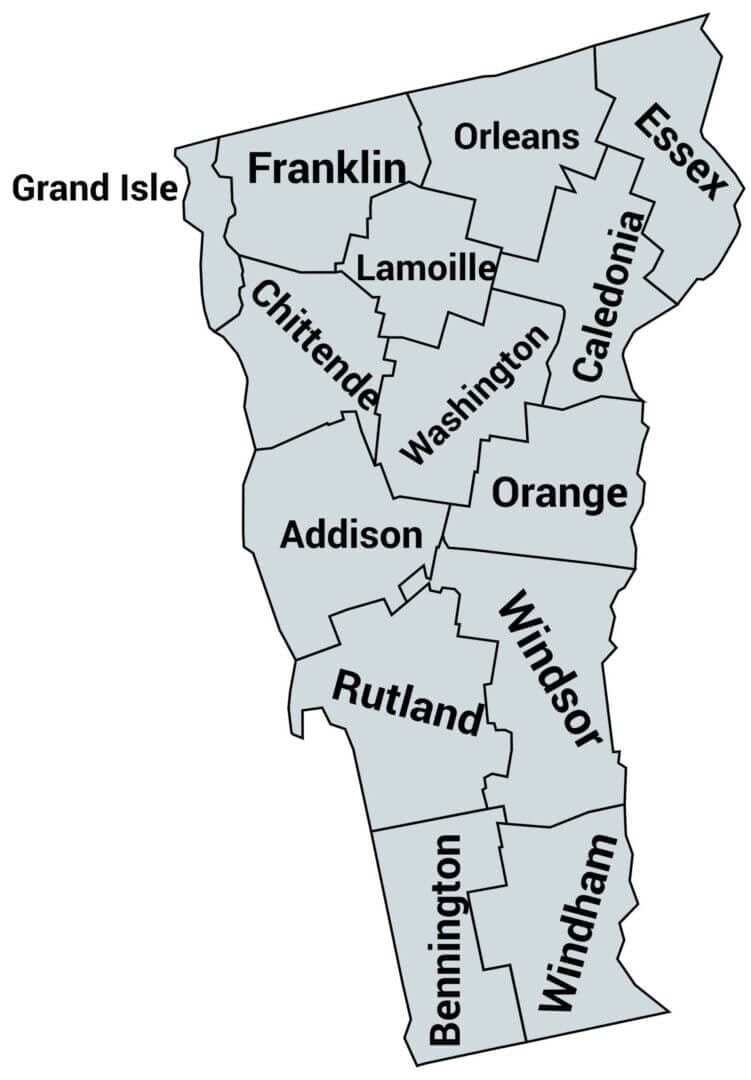

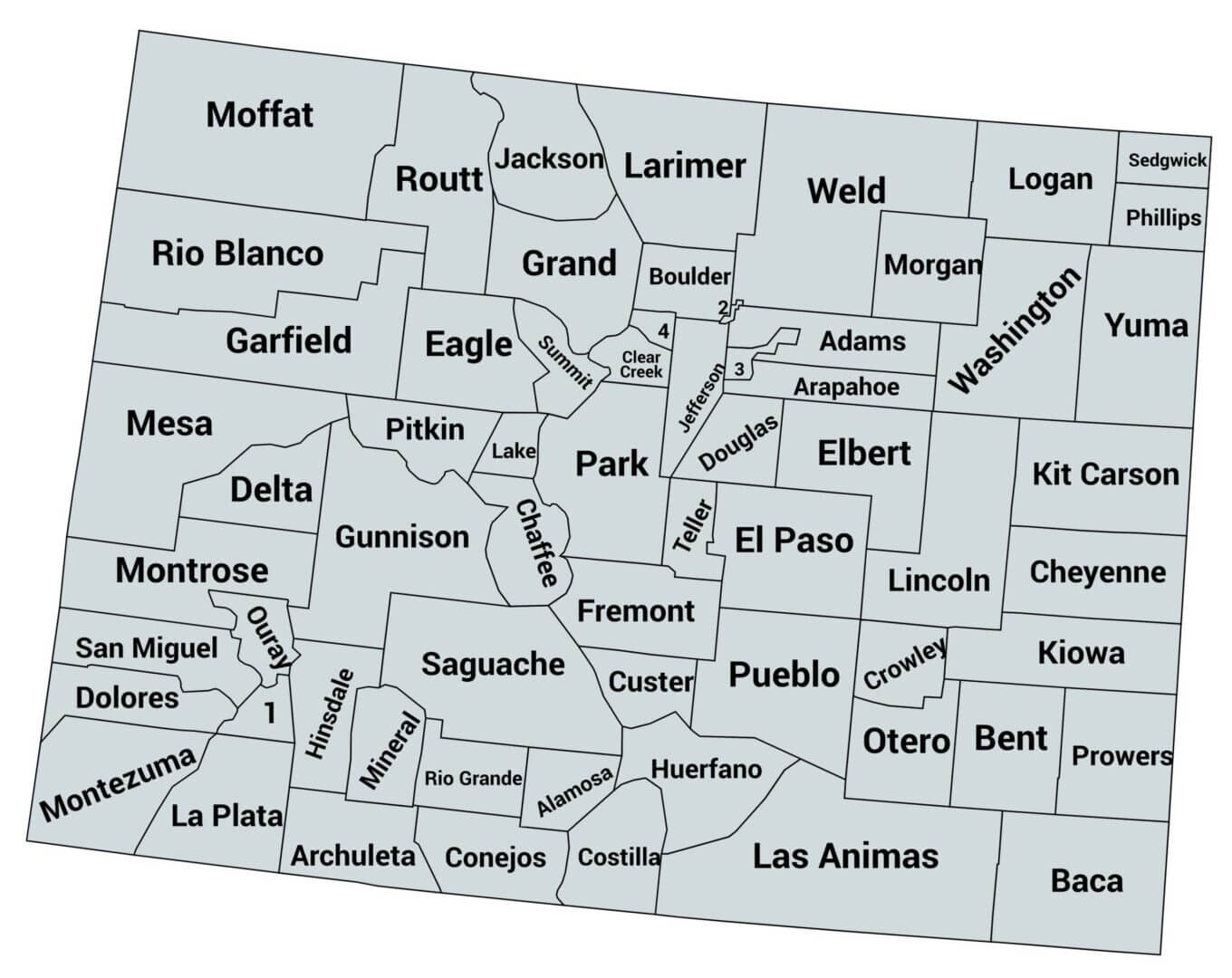

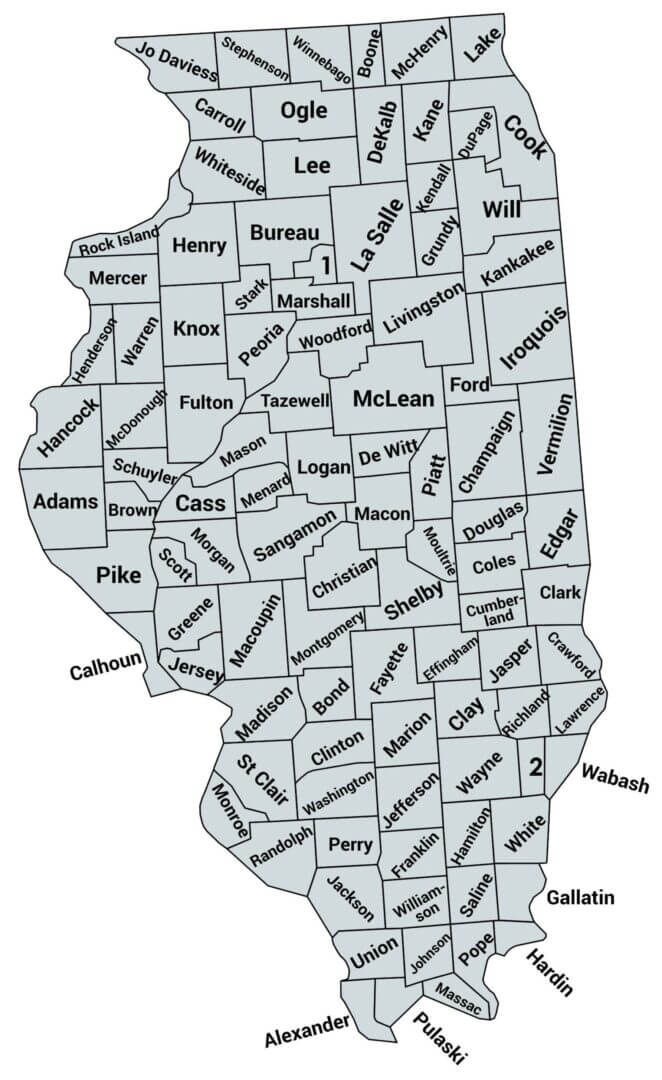

The Essential List Of Tax Lien Certificate States

Web Avoid a Lien.

. Unless action is taken by the IRS to refile a lien federal tax liens typically expire 30 days after the tenth anniversary on which they. Use Ownerly To Help You Search For Millions Of Liens Online. Ad 2022s Best Housing Loans Rates Comparison.

Ad Register for Instant Access to Our Database of Nationwide Foreclosed Homes For Sale. Ad Search Valuable Data On Properties Such As Liens Taxes Comps Pre-Foreclosures More. Web Can you get a mortgage with a state tax lien.

HUD Homes USA Can Help You Find the Right Home. Use Ownerly To Help You Search For Millions Of Liens Online. This is the best way to get rid of a tax lien on your home.

Ad Realize Your Dream of Having Your Own Home. Web Borrowers can qualify for an FHA mortgage with tax lien under certain circumstances. But I dont suggest you hide any delinquent taxes.

Use NerdWallet Reviews To Research Lenders. Web Normally if you have equity in your property the tax lien is paid in part or in whole depending on the equity out of the sales proceeds at the time of closing. Browse Information at NerdWallet.

Web HUD allows you to qualify for a mortgage with a federal tax lien under conditions you have a written payment agreement and have made three months of timely. Web Once your tax lien is satisfied the IRS will release it within 30 days of your payment. Have the title agent.

View Ratings of the Best Mortgage Lenders. Pay your bill in full. Apply Online Get Pre-Approved Today.

Get the Latest Foreclosed Homes For Sale. Ad Register for Instant Access to Our Database of Nationwide Foreclosure Listings. Have the back taxes paid prior to or at closing.

All filers get access to Xpert Assist for free. Web Yes there is a statute of limitations. Ad Search Valuable Data On Properties Such As Liens Taxes Comps Pre-Foreclosures More.

Web So can you get a mortgage with a tax lien Yes. Depending on the actions of the homeowners the property may. Take Advantage And Lock In A Great Rate.

If you cant file or pay on time dont ignore the letters or correspondence. Signup Now To Get a 1 Trial. Skip The Bank Save.

Web As an investor you can purchase a tax lien from the county for properties with unpaid taxes. View Ratings of the Best Mortgage Lenders. Ad Realize Your Dream of Having Your Own Home.

Apply for Your Mortgage Now. Your lender will find any unpaid taxes and judgment lien. Are you wondering if state tax liens will make it harder to get a mortgage.

Web Other ways to get rid of a tax lien. Apply Easily And Get Pre Approved In a Minute. Learn about voluntary and involuntary mortgage liens and how they work.

The IRS releases the lien within 30 days of the. Ad Learn More About Mortgage Preapproval. Apply for Your Mortgage Now.

Once a Notice of State Tax Lien is recorded or filed against you the lien. NerdWallet users get 25 off. Web Tax lien investing is a type of real estate investing where individuals purchase tax lien certificates.

These certificates are created when local governments. The IRS has 10 years from the date of filing the lien to collect the amount due. Web A mortgage lien is a creditors legal claim on a property.

Use Our Comparison Site Find Out Which Lender Suites You The Best. Lock Rates For 90 Days While You Research. Compare Rates of Interest Down Payment Needed in Seconds.

This holds true as long as they have a written payment agreement and has been paying on it for at. Ad Compare Best Mortgage Lenders 2023. Web A lien secures our interest in your property when you dont pay your tax debt.

Web Free version available for simple tax returns only. If you have a tax lien lenders will make you undergo a manual. If you sell your home for.

Web state tax liens against real prop-erty must be filed in the county clerks office in the county where the real property is located. Web Borrowers can qualify for Mortgage With Judgment And Tax Liens. Web Say you also have a tax lien of 30000 on your home filed by your county government because youve failed to pay your property taxes.

You can avoid a federal tax lien by simply filing and paying all your taxes in full and on time. Compare Rates of Interest Down Payment Needed in Seconds. Watch this video to find out the an.

A foreclosure of a prior secured lien terminates.

Low Risk Profits From Tax Liens And Tax Deeds

Can You Get A Mortgage If You Owe Back Taxes To The Irs Jackson Hewitt

Tax Lien Mortgage Guidelines For Home Loan Approval

The Essential List Of Tax Lien Certificate States

Tax Lien Mortgage Guidelines For Home Loan Approval

Tax Lien Certificates Vs Tax Deeds What S The Difference Proplogix

The Essential List Of Tax Lien Certificate States

Can You Get A Mortgage If You Owe Back Taxes To The Irs Jackson Hewitt

The Tax Lien Cometh Deeds Com

Can You Get A Mortgage If You Owe Federal Tax Debt To The Irs

Investing In Property Tax Liens

The Essential List Of Tax Lien Certificate States

Tax Lien Mortgage Guidelines For Home Loan Approval

Tax Liens And Judgments Mortgage Guidelines And Lender Overlays

The Essential List Of Tax Lien Certificate States

Tax Lien Certificates Vs Tax Deeds What S The Difference Proplogix

The Essential List Of Tax Lien Certificate States